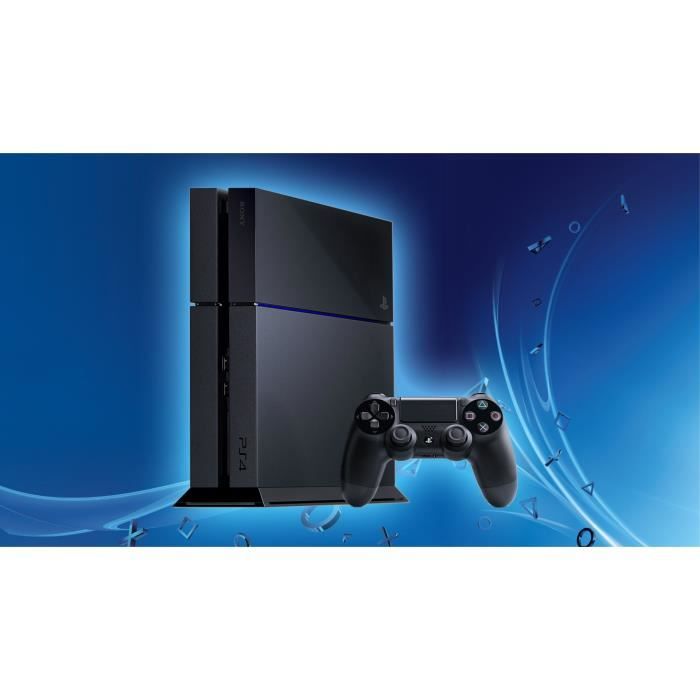

Sony PlayStation 4 - Ultimate Player 1TB Edition - console de jeux - 1 To HDD - noir de jais - Console PlayStation 4 - Achat & prix | fnac

![IT TAKES TWO - (inkl. kostenloser Update auf PS5 Version) - [Playstation 4] - Import allemand : Amazon.fr: Jeux vidéo IT TAKES TWO - (inkl. kostenloser Update auf PS5 Version) - [Playstation 4] - Import allemand : Amazon.fr: Jeux vidéo](https://images-eu.ssl-images-amazon.com/images/I/614ZF1OC77L._AC_UL750_SR750,750_.jpg)

IT TAKES TWO - (inkl. kostenloser Update auf PS5 Version) - [Playstation 4] - Import allemand : Amazon.fr: Jeux vidéo